Legal and tax information to reside in Spain

Tax procedures

WHEN IT IS CONSIDERED THAT YOU ARE A RESIDENT IN SPAIN?

- When you live more than 183 days in Spain.

- When you work and have economic interests here.

WHO IS OBLIGATED TO PAY THE NON RESIDENT TAX IN SPAIN?

- All those people who have a property in Spain and are non residents.

NON RESIDENTS WITH A PROPERTY IN SPAIN HAVE TO PAY FOLLOWING TAXES:

- NON RESIDENT TAX.

- GROUND TAX

WHAT IS THE NECESSARY DOCUMENTATION FOR THE NON RESIDENT DECLARATION?

- The receipt of the ground tax (TOWNHALL-SUMA OFFICE)

- Title deeds

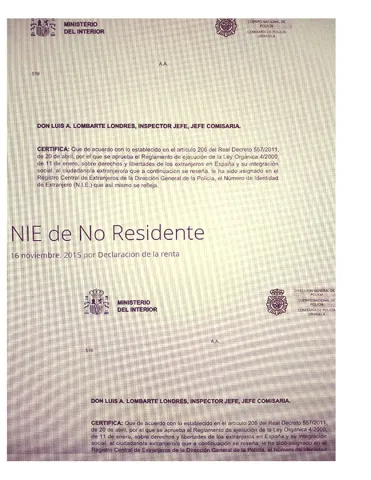

- The NIE number from the owner (if there are several owners, from all of them)

WHAT IS THE GROUND TAX RECEIPT?

- It is a local tax.

- The amount is set by the city council.

- The receipt will be sent by post to the house.

- The payment is yearly.

- The payment period is from SEPTEMBER – OCTOBER. Sometimes until NOVEMBER, it depends from the Town Hall.

- In the province of Alicante the receipt is sent by SUMA.

- This receipt is necessary to calculate the amount for the non resident tax.

WHAT IS THE DEADLINE TO PAY THE NON RESIDENT TAX?

- You can pay it all year round.

- For example: The declaration from the year 2018 can be paid from 1st of Januray until the 31st of december 2019. Throughout the year 2019.

- Non resident owners are required to have a tax representative .

- For this reason, it is necessary to deliver the documents to an expert, who will verify what you are required to declare. He will be also the internediary between you and the Inland Revenue Office for any problem.

Purchase and sale procedures

Other support services

Subscribe to our newsletter